Step-by-Step Guide: Setting Up Roth 401(k) or IRA Calculations in Sage

Updated On: April 16, 2025 12:10 pm

Setting up a Roth 401(k) or IRA can be a daunting task for many individuals. There are numerous factors involved, including tax brackets, income levels, and other investment decisions that must be taken into account. However, there are ways to simplify the process and ensure you get the most out of your retirement plan. In this blog post, we’ll explore how to set up a Roth 401(k) or IRA calculation in Sage.

User Navigation

Accounting Professionals & Specialized Experts

Want quick help from accounting software experts? Get in touch with our team members who can install, configure and configure your software for you. Proficient in fixing technical issues, they can help you quickly get back to work whenever you encounter an error in Sage software. Our team is available 24/7 365 days to assist you. To get in touch.

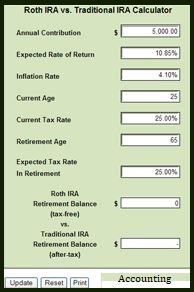

Sage is one of the most well-known accounting software programs used worldwide by businesses both large and small. It is a platform that enables even non-accountants to enjoy the benefits of user-friendly accounting applications, leading to improved productivity. One of the helpful features in Sage is the Roth 401(k) or IRA calculator, designed to make retirement planning easier for users. But first, let’s understand what a Roth 401(k) is and how it helps.

Roth 401-K

A Roth 401(k) is an employer-sponsored savings account that is funded using after-tax dollars. This means income tax is paid on the earnings deducted from each paycheck before the funds are deposited into the account. The major advantage is that withdrawals made during retirement are tax-free.

The main difference between a Roth 401(k) and a traditional account is that the latter is funded with pre-tax money. In that case, payroll deductions occur from the employee’s gross income, and taxes are paid only when the money is withdrawn from the account.

How to Set Up Roth 401(k) or IRA Calculation in Sage?

To set up a Roth 401(k) or IRA calculation in Sage, follow these steps:

- Launch the 5-3-1 Payroll Calculations module.

- Go to the Data Control box.

- Enter the number you’d like to assign for this calculation.

- Go to the Description box.

- Enter a name for the calculation — this name will appear on employee paystubs.

- Open the Tax Type menu.

- Select “0 – None” for a traditional IRA, or choose the post-tax Roth 401(k) option.

- Open the Calculation Type menu and select “1 – Deduct from Employee.”

- Go to the Calculation Method menu and choose the appropriate method.

- Avoid typing a default rate if the rate varies by employee.

- In the Credit Account box, enter the ledger account where the liability should accrue.

- Open the File menu.

- Click Save and then Exit.

It’s highly recommended to consult your 401(k) provider or a CPA to ensure you’re using the correct method for each employee. Be sure to set up separate calculations for employees contributing a percentage and those contributing a flat rate.

Advantages of a Roth 401(k)

Some of the main benefits of a Roth 401(k) include:

- Recommended for individuals expecting to be in a higher tax bracket in the future.

- Distributions during retirement are generally tax-free.

- Earnings within the account are tax-free.

Disadvantages of a Roth 401(k)

While beneficial, the Roth 401(k) has some drawbacks:

- Contributions are made using after-tax dollars.

- Contributions do not reduce your current taxable income.

What is an Individual Retirement Account (IRA)?

An IRA is an excellent option for individuals who cannot or choose not to invest in an employer-sponsored plan. This type of account can be set up through an investment firm or financial institution. Essentially, anyone who earns income is eligible to open an IRA.

The best part about IRAs is the variety of investment options available, including stocks, bonds, exchange-traded funds (ETFs), and real estate investment trusts (REITs). There are two main types of IRAs:

Traditional IRA

Traditional IRAs are tax-deductible and can reduce your taxable income. Withdrawals made during retirement are taxed according to your normal tax rate.

For the year 2022, individuals under 50 can contribute up to $6,000. This limit increases to $6,500 in 2023. If you are over 50, you can contribute an additional $1,000 each year.

Roth IRA

Contributions to a Roth IRA are made with after-tax dollars, meaning they do not reduce your taxable income. Contribution limits are the same as for traditional IRAs. The key benefit is that withdrawals made during retirement are tax-free.

Another advantage of the Roth IRA is that there is no required minimum distribution (RMD). You can leave your funds in the account as long as you like. However, if you withdraw money before age 59½, you may face a 10% early withdrawal penalty.

Final Words

As you can see, the Roth 401(k) is a valuable tool for retirement investment. It’s essential to start investing early to take full advantage of Roth IRA benefits. Like other plans, it often includes employer-matching contributions. However, a key distinction is that Roth accounts are funded with after-tax dollars, unlike traditional 401(k) plans. This means you won’t pay income taxes when you take distributions during retirement.

If you need technical support with Sage or setting up retirement calculations, feel free to call 1-800-964-3096.

Frequently Asked Questions:

What are the categories for the Roth 401(K) withdrawals?

One of the most important criteria for the Roth 401(k) withdrawals is that one needs to be an account holder for a minimum of five years and has been of age 59 and a half years. However, exceptions are in case of being disabled or dying. One also needs to make a minimum distribution if you are 72 years of age and work for a company that holds the 401 (K) and does not have ownership of a minimum of 5% stake in the business that sponsors the plan.

Can one lose Money in Roth 401(k)?

Yes, one can easily lose money in case the market suffers a massive loss. Nevertheless, there are companies that offer various choices of funds along with very low-risk options like that of the government bond fund. One can easily mix and match the funds to acquire the level of risk that one can easily deal with. One can also lose money if the rules are bokeh by the account holder or take early distributions. In case one needs to withdraw the money early, you need to get in touch with the fund administrator to find out if you owe a tax penalty.

What are the basic workings of the Roth 401 (K) Plan?

Only an employer can avail the Roth 401(K) plan, hence the individual cannot set up their own accounts in this manner. One can make contributions using after-tax dollars done via payroll deductions. This allows the contributions to grow tax-free in the account. Not, just that, but the withdrawals are also tax-free in case the user has held the account for a minimum of five years and is of age 59 and a half years.